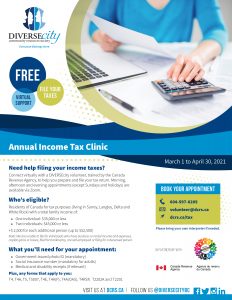

Need help filing your income taxes?

Need help filing your income taxes?

Connect virtually with a DIVERSEcity volunteer, trained by the Canada Revenue Agency, to help you prepare and file your tax return. Morning, afternoon and evening appointments (except Sundays and holidays) are available via Zoom.

Who’s eligible?

Residents of Canada for tax purposes (living in Surrey, Langley, Delta and White Rock) with a total family income of:

- One individual: $35,000 or less

- Two individuals: $45,000 or less

+$ 2,500 for each additional person (up to $52,500)

Note: We are unable to file for individuals who have business or rental income and expenses,

capital gains or losses, filed for bankruptcy, are self-employed or filing for a deceased person.

What you’ll need for your appointment:

- Government-issued photo ID (mandatory)

- Social insurance number (mandatory for adults)

- Medical and disability receipts (if relevant)

Plus, any forms that apply to you:

- T4, Statement of Remuneration Paid

- T4A, Statement of Pension, Retirement, Annuity and other Income

- T5, Statement of Investment Income

- T5007, Statement of Benefits

- T4E, Statement of Employment Insurance

- T4A(P), Statement of Canada Pension Plan Benefits

- T4A(OAS), Statement of Old Age Security

- T4RSP, Statement of RRSP Income

- T2202A, Tuition, Education and Textbook Amounts

- T2201, Disability Tax Credit Certificate

If you have any other questions about the tax clinics or resources to help you file your taxes, please email volunteer@dcrs.ca