Need help filing your income taxes?

Connect with a DIVERSEcity volunteer, trained by the Canada Revenue Agency, to help you prepare and file your tax return.

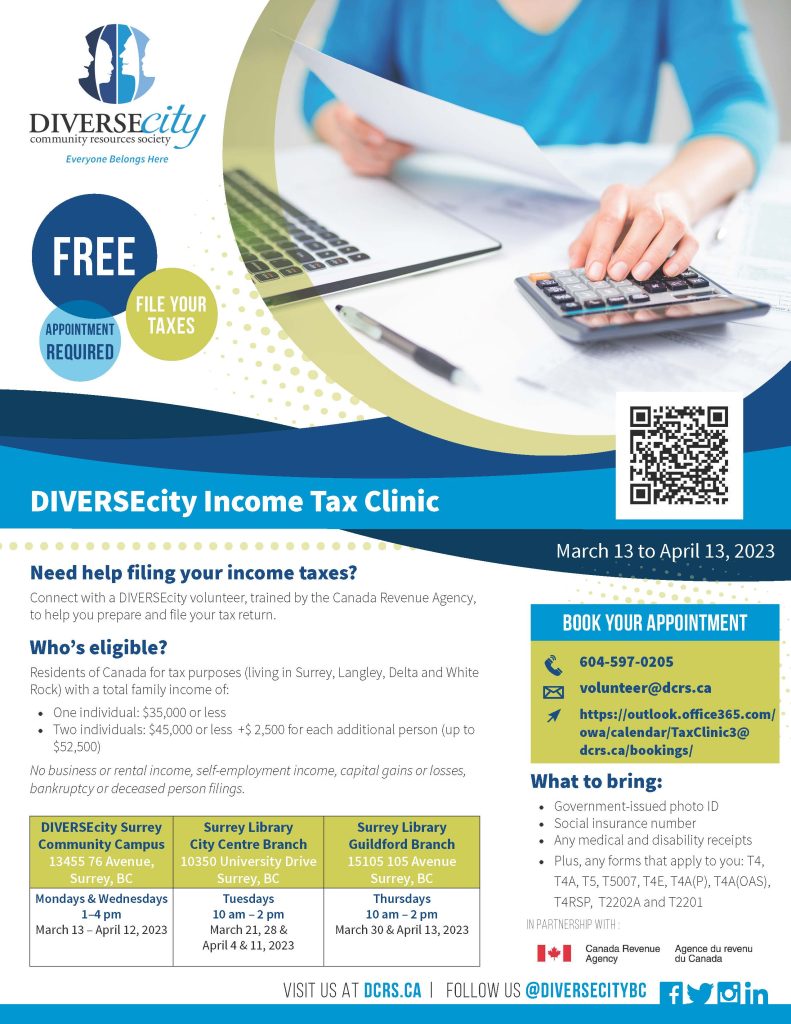

DIVERSEcity Surrey Community Campus (13455 76 Avenue, Surrey, BC)

- Mondays & Wednesdays, 1–4 pm

- March 13 – April 12, 2023

Surrey Library City Centre Branch (10350 University Drive, Surrey, BC)

- Tuesdays, 10 am – 2 pm

- March 21, 28 & April 4 & 11, 2023

Surrey Library Guildford Branch (15105 105 Avenue, Surrey, BC)

- Thursdays, 10 am – 2 pm

- March 30 & April 13, 2023

Who’s eligible?

Residents of Canada for tax purposes (living in Surrey, Langley, Delta and White Rock) with a total family income of:

• One individual: $35,000 or less

• Two individuals: $45,000 or less +$ 2,500 for each additional person (up to

$52,500)

No business or rental income, self-employment income, capital gains or losses, bankruptcy or deceased person filings.

What to bring:

• Government-issued photo ID

• Social insurance number

• Any medical and disability receipts

• Plus, any forms that apply to you: T4, T4A, T5, T5007, T4E, T4A(P), T4A(OAS), T4RSP, T2202A and T2201

To book your appointment please call 604-597-0205, email volunteer@dcrs.ca, or visit: https://outlook.office365.com/owa/calendar/TaxClinic3@dcrs.ca/bookings/