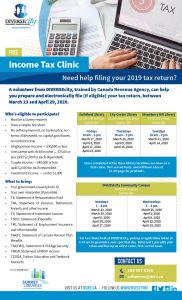

Need help filing your 2019 tax return?

Need help filing your 2019 tax return?

A volunteer from DIVERSEcity, trained by Canada Revenue Agency, can help you prepare and electronically file (if eligible) your tax return, between March 23 and April 29, 2020.

Who’s eligible to participate?

• Must be a Surrey resident

• Have a simple tax return

• No self employment, no bankruptcy, no forms of deceased, no capital gain/losses, no rental income

• Single person income — $30,000 or less

• One parent with child income — $35,00 or less (add $2,500 for each dependent)

• Couple income — $40,000 or less (add $2,500 for each dependent)

• Investment income — under $1,000

What to bring:

• Your government-issued photo ID

• Your own interpreter (if possible)

• T4, Statement of Renumeration Paid

• T4A, Statement of Pension, Retirement, Annuity and other income

• T5, Statement of Investment Income

• T5007, Statement of Benefits

• T4E, Statement of Employment Insurance and other benefits

• T4A(P), Statement of Canada Pension Plan Benefits

• T4A(OAS), Statement of Old Age Security

• T4RSP, Statement of RRSP income

• T2202A, Tuition, Education and Textbook Amounts

For more information, call 604-597-0205, or email: volunteer@dcrs.ca